About Paul B Insurance Medigap

Wiki Article

What Does Paul B Insurance Medigap Do?

Table of ContentsThe Best Strategy To Use For Paul B Insurance MedigapTop Guidelines Of Paul B Insurance MedigapThe Facts About Paul B Insurance Medigap RevealedFacts About Paul B Insurance Medigap RevealedUnknown Facts About Paul B Insurance Medigap4 Easy Facts About Paul B Insurance Medigap Described

You will certainly want to track your medical expenditures to reveal you have actually met the insurance deductible. Similar to a disastrous plan, you might be able to pay much less for your insurance with a high-deductible health insurance (HDHP). With an HDHP, you may have: Among these kinds of health strategies: HMO, PPO, EPO, or POSHigher out-of-pocket prices than lots of kinds of strategies; like various other plans, if you get to the maximum out-of-pocket quantity, the plan pays 100% of your treatment.In order to have a HSA, you need to be enlisted in a HDHP.Many bronze plans might qualify as HDHPs relying on the deductible (see below). hat physicians you can see. This varies relying on the type of strategy-- HMO, POS, EPO, or PPOPremium: An HDHP typically has a lower premium compared to other strategies.

Like with all plans, your precautionary treatment is free also if you haven't fulfilled the insurance deductible. Copays or coinsurance: Aside from preventative care, you need to pay all your prices approximately your deductible when you go with treatment. You can use money in your HSA to pay these prices.

Unknown Facts About Paul B Insurance Medigap

The maximum you can contribute to an HSA in 2020 is $3,550 for individuals and $7,100 for households. Documentation involved. Keep all your receipts so you can withdraw cash from your HSA as well as know when you've satisfied your insurance deductible.Medicare beneficiaries pay nothing for most preventative solutions if the services are gotten from a doctor or various other wellness treatment provider that takes part with Medicare (additionally called approving assignment). For some precautionary solutions, the Medicare recipient pays nothing for the solution, however may have to pay coinsurance for the office visit to receive these services.

Some Known Details About Paul B Insurance Medigap

Remember, you do not require to obtain the Welcome to Medicare physical examination prior to obtaining an annual Health exam (paul b insurance medigap). If you have had Medicare Part B for longer than twelve month, you can get an annual wellness see to develop or upgrade a customized avoidance plan based on your existing wellness as well as danger factors.

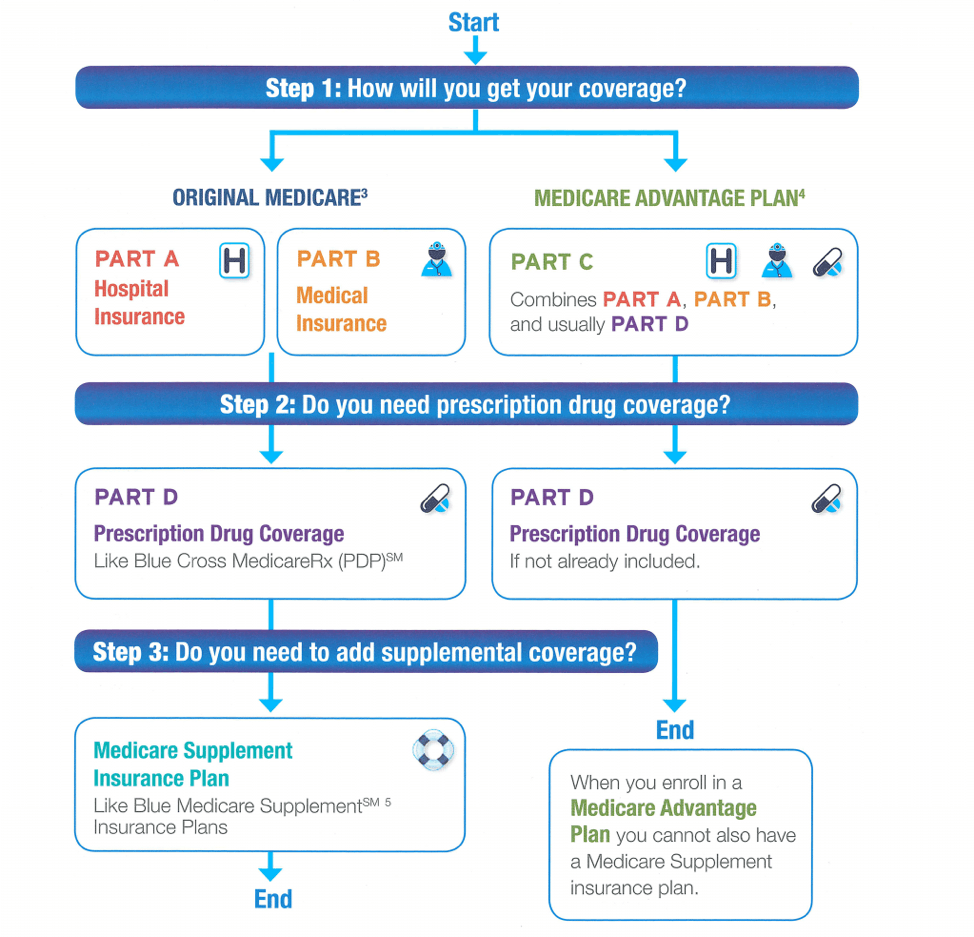

This exam is covered once every year. Medicare Supplement (Medigap) insurance policy is medical insurance offered by exclusive insurance provider to cover several of the "voids" in expenses not covered by Medicare. For plans marketed before June 01, 2010, there are fourteen Continued standard plans A via L. For policies sold on or after June 01, 2010, there are 11 standardized strategies A via N.

Some of the standardized Medigap plans also provide added advantages such as proficient nursing facility coinsurance and also foreign traveling emergency situation care. In order to be eligible for Medigap protection, you have to be enrolled in both Component An and Part B of Medicare. Since June 1, 2010, alters to Medigap resulted in adjustments to the previously standardized plans offered by insurance firms.

Paul B Insurance Medigap Fundamentals Explained

Plan E was additionally removed as it corresponds a currently readily available plan. Two new plan choices were added and also are currently offered to recipients, which have greater cost-sharing responsibility and reduced estimated premiums: Strategy M includes 50 percent coverage of the Medicare Component An insurance deductible and also does not cover the Part B insurance deductible Strategy N does not cover the Part B insurance deductible as well as includes a brand-new co-payment framework of $20 for each physician go to as well as $50 for each emergency clinic browse through (waived upon admission to hospital) Particular Medigap benefits were additionally be updated.In its place, a brand-new Hospice Care advantage was developed and was included as a basic benefit readily available in every Medigap strategy. paul b insurance medigap. The under-utilized Preventive Care Advantage, which was formerly only offered in Plans E and also J, was eliminated. The 80 percent Medicare Component B Excess advantage, offered in Plan G, was altered to an one hundred percent insurance coverage benefit.

Formerly insurance firms only had to supply Strategies An and B. Individuals enrolled in plans with an efficient date before June 01, 2010 can keep their existing plans in force. Medicare supplement insurance is assured renewable. As of January 1, 2020, the Medicare Accessibility and also CHIP Reauthorization Act (MACRA), which the federal government established in 2015, led to alterations to the schedule of specific Medigap strategies - paul b insurance medigap.

Paul B Insurance Medigap Can Be Fun For Anyone

"Freshly eligible" is specified as those individuals that first end up being eligible for Medicare as a result of age, impairment, or end-stage renal condition, on or after January 1, 2020. Existing insureds covered under strategies C, F, or high-deductible strategy F before January 1, 2020 may proceed to restore their protection due to guaranteed you could try here renewability.On or after January More hints 1, 2020, insurance providers are required to use either Strategy D or G in addition to An as well as B. The MACRA adjustments also developed a new high-deductible Strategy G that may be provided starting January 1, 2020. For more details on Medicare supplement insurance strategy design/benefits, please see the Benefit Chart of Medicare Supplement Plans.

Insurance providers may not reject the applicant a Medigap policy or make any kind of premium price distinctions due to wellness condition, asserts experience, medical problem or whether the applicant is obtaining health and wellness treatment services. Qualification for plans supplied on a team basis is limited to those people who are participants of the group to which the plan is provided.

The Of Paul B Insurance Medigap

Report this wiki page